OECD Report On Pillar II Implementation Has Been Released

Summary

Pillar II

1) Who Fall in The Scope?

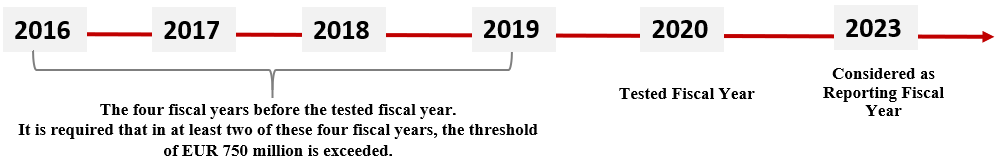

It is envisaged that the GloBE rules apply to the members of Multinational Entities (“MNE”) (“Constituent Entities”) and that exceeds EUR 750 million threshold in at least two of the four fiscal years preceding the tested fiscal year[1]. The scope can be schematized as follows.

Under the OECD Report, a Group means that a collection of entities that are related through ownership or control mechanisms such that the assets, liabilities, income, expenses and cash flow in consolidated financial statements and that entities that is located in one jurisdiction and has one or more permanent establishments located in other jurisdictions. A constituent entity is defined as any entity that is included in a group and any permanent establishment of a main entity.

Besides, it is stated that those who has no presence in the jurisdiction except the jurisdiction where it is located in, the entities that does not exceed certain threshold, governmental entities, international organisations, not-for-profit organisations, pension funds, investment funds or real estate investment vehicles that are the ultimate parent entity of a MNE group are excluded.

2) Significant Points on the GloBE Rules

Pillar II provides new model with GloBE rules stipulating the implementation of an effective tax rate at 15% and provides new definitions of the tax base in global level and covered tax in order to determine the jurisdiction where the tax rate is applied lower than 15%. Pillar II proposal contains two core elements that constitutes GloBE rules:

- Income Inclusion Rule (“IIR”): a top up tax shall be applied over low-taxed income derived by the ultimate parent entity through IIR. In other words, the ultimate parent entity is considered responsible priorly. If the state where the ultimate parent entity of MNE group is located implement the GloBE rules, it is envisaged that main partner shall pay additional tax which is called “a top up tax”. On the other hand, if the state where the ultimate parent entity is located did not implement the GloBE rules, the burden shifts to the lower parent entity[2].

- Undertaxed Payment Rule (“UTPR”): it aims denial of jurisdictional deduction of the low-taxed income in the event that low-taxed entities is not subject to the IIR.

In addition to these two rules hereby, no explanations were provided on Subject To Tax Rule (“STTR’’) in OECD Report.

3) Computation of Top-up Tax

Priorly, subsequent to determination of whether or not GloBE rules will be applied to MNE Group; which constituent entities shall be evaluated withing this scope and the jurisdictions of these entities; GloBE income over which top-up tax is computed and its scope will be determined. Afterwards, IIR or UTPR shall be applied.

1. Step : Determinations of MNE Group falling into scope and the jurisdictions.

2. Step : Determination of the GloBE Income

a. Determination of the Financial Accounting Net Income or Loss[3]

b. Adjust Financial Accounting Net Income or Loss to GloBE Base

c. Allocation of GloBE Income or Loss determined by such way

3. Step : Determination of the Covered Tax

a. Determination of current tax burden

b. Adjustment of this tax per the certain standards identified in OECD Report

c. Allocation of the covered tax as necessary

4. Step : Determination of the Effective Tax Rate and Top-up Tax

a. Computation of jurisdictional top-up tax[4]

b. Determination of the top-up tax[5] to be applied, in the event that jurisdictional Effective Tax Rate is lower than 15%

c. Determination of jurisdictional tax rate by applying the top-up tax rate to certain Excess Profit[6]

The process explained above is as follows in summary.

5. Step : Implementation of UTPR

a. Identification of the Parent Entity liable for the Top-up Tax under the IIR

b. Determination of amount of Top-up Tax paid by the Parent Entity under the IIR

c. Identification of the remaining amount, if any, that is allocable under the UTPR

d. Determination of the amount to be paid within the scope of the UTPR

Furthermore, in the event that the GloBE revenue is less than EUR 10 million and GloBE Income (or Loss) is less than EUR 1 million in the relevant jurisdiction, no top-up tax will be due for jurisdictions.

4) When the Rules Are Expected to Enter into Force?

The expected timeline is that the domestic law process of Pillar II rules to be completed within the course of 2022 and the rules to be applied will enter into force in 2023.

However, the timeline on implementation of STTR differs. In order to enter STTR into force, the amendments on the treaties are required and it is expected that a treaty provision will be developed in mid-2022.

[1]It is understood from the tested fiscal year that the third year preceding the tested fiscal year. Reporting Fiscal Year means the Fiscal Year that is subject of the GloBE Information Return that shall be filed in a standard template that is developed in accordance with the GloBE Implementation Framework and which is envisaged to include certain information.

[2]Top-down Approach

[3]Financial Accounting Net Income or Loss is the net income or loss determined for a Constituent Entity in preparing Consolidated Financial Statements per the accounting standards identified in OECD Report (e.g IFRS).

[4]It will be determined by proportioning jurisdictional computed covered taxes to jurisdictional computed GloBE income,

[5]For instance, in the event that Jurisdictional Effective Tax Rate is 10%, the top-up tax percentage is equal to 5% (15%-10%)

[6]Excess profit shall be determined by extracting the Substance-based Income from the Net GloBE Income.